ADNOC Gas Reports Net Income of $2.3 Billion Delivering Robust Financial Performance in H1 2023

Company demonstrated resilience of its business model by maintaining stable margins in a lower price environment

Robust H1 2023 performance places the Company firmly on track to meet its 2023 guidance

Recent $1.34 billion contract awards for new natural gas pipeline to the Northern Emirates underscore ADNOC Gas’ commitment to profitable growth

Abu Dhabi, UAE – August 4, 2023: ADNOC Gas plc (together with its direct and indirect subsidiaries, “ADNOC Gas” or the “Company”) (ADX symbol: “ADNOCGAS” / ISIN: “AEE01195A234”), the world-class integrated gas processing company, today announced its financial results for the three months and six months ended June 30, 2023 (“Q2 2023” and “H1 2023”). The unaudited pro forma financial results of the Company for the comparative period (i.e., the three and six-month period ended June 30, 2022 (“Q2 2022” and “H1 2022”) noted herein are reported on a Pro Forma Adjusted basisi.

Robust financial performance despite pricing impact

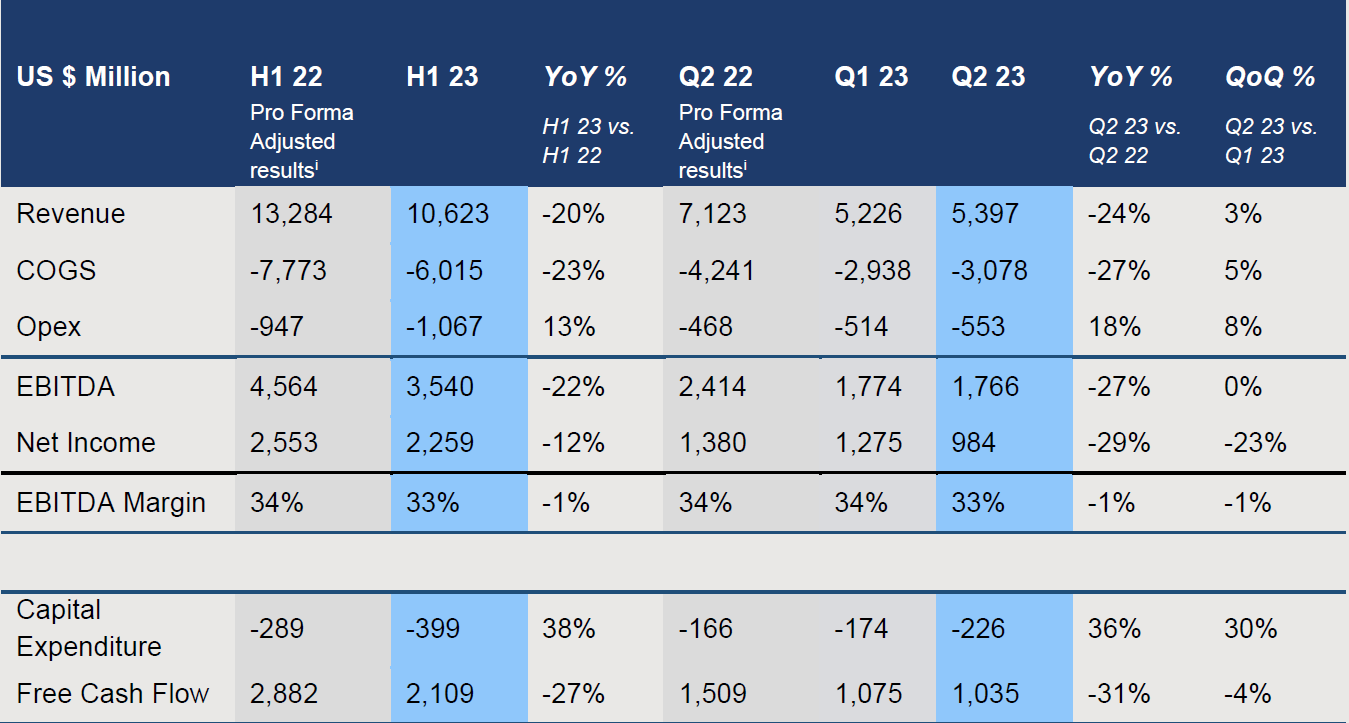

The Company’s H1 2023 revenue stood at a $10.6 billion compared to Pro Forma Adjusted Revenue of $13.3 billion in H1 2022, impacted by the pricing environment. Revenue in Q2 2023 was reported at $5.4 billion compared to Pro Forma Adjusted Revenue of $7.1 billion in Q2 2022. ADNOC Gas maintained high reliabilityii with a 98.9% average across its facilities in H1 2023, contributing to a 15% increase in production volumes in Q2 2023 over Q1 2023.

ADNOC Gas adapted to lower LPG and Brent crude oil prices in H1 2023 compared to the high pricing environment of H1 2022. The Company strategically shifted towards higher-margin export liquids and focused on increased efficiency. These measures enabled the Company to maintain a flat EBITDA of $1.8 billion and Net Income of $1.0 billion in Q2 2023, demonstrating that ADNOC Gas is a predictable and resilient margin business underpinned by profitable growth.

Ahmed Alebri, Chief Executive Officer of ADNOC Gas, commented: “Our results for the first half of 2023 showcase the resilience and robustness of our business in the current lower price environment compared to the higher prices witnessed in H1 2022. For the period ending 30 June 2023, we delivered a net income of $2.3 billion. This performance demonstrates the strength of our business, which was also supported by selling more high-margin export liquids – a strategy that has proven effective.

“We continue to witness long-term structural demand growth for natural gas as a critical fuel for the responsible global energy transition. ADNOC Gas remains fully committed to investing in our people, operations, and markets, and we have continued to invest in our strategic growth opportunities throughout the first half of 2023.

“Our recent signing of significant long-term LNG agreements and our domestic investments demonstrate that we remain ideally positioned to meet both local and international demand, while further decarbonizing our operations in line with the UAE’s Net-Zero 2050 ambition, as we continue to deliver value for our shareholders over the longer-term.”

Continuing to invest in growth

In line with ADNOC Gas’ growth strategy, the Company recently awarded $1.34 billion in contracts for extending its natural gas pipeline to over 3,500km, serving the Northern Emirates, marking another key milestone for the sales gas pipeline network enhancement (ESTIDAMA) program. This strategic pipeline extension will drive further growth for ADNOC Gas as it continues to provide sustainable gas supplies to customers in support of the UAE’s plan to achieve gas self-sufficiency.

Focused on broadening the international customer base

ADNOC Gas continues to capitalize on the growing global demand for natural gas while extending its reach and reputation as a reliable supplier. In a significant post-period event, on July 18, ADNOC Gas announced a $7-9 billion 14-year supply agreement with Indian Oil Corporation Ltd. (IOCL) for the export of up to 1.2 mmtpa of LNG. This comes on the heels of the Company’s Q2 2023 signing of a supply agreement with TotalEnergies Gas and Power for the export of LNG to various markets around the world. In February, ADNOC Gas made the first-ever delivery of LNG from the Middle East to Germany, paving the way for longer-term deliveries.

Dividend guidance maintained

As stated during its IPO, ADNOC Gas maintains its dividend target of $1.625 billion in the fourth quarter of 2023 and a further $1.625 billion dividend in the second quarter of 2024. Thereafter, ADNOC Gas expects to grow the annual target dividend amount by 5% per annum on a per-share basis over the 2024-2027 period. The targeted growth in dividends underscores ADNOC Gas’ strong and visible future cash flows, which provide ample headroom to invest in long-term future growth and provide stable returns for shareholders.

_______________________________________

i ADNOC Gas was incorporated in the Abu Dhabi Global Market, Abu Dhabi, UAE on 8 December 2022 and the relevant assets were contributed to ADNOC Gas effective 1 January 2023 as part of a reorganisation (the “Reorganisation”) that included the entry into a gas supply and purchase agreement, a transitional marketing and transportation agreement, a sulphur sales and marketing agreement, a pipelines use and operation agreement, a re-injection gas sale agreement and certain lease agreements. The unaudited pro forma financial results for H1 2022 presented in this document give effect to the impact of the Reorganisation as if the Reorganisation had taken place on 1 January 2022. The unaudited pro forma financial results for H1 2022 have been prepared for illustrative purposes only and are based on available information and certain assumptions and estimates that we believe are reasonable and may differ materially from the actual amounts that would have been achieved had the Reorganisation taken place on 1 January 2022.

ii Reliability is defined as total available hours (8,760 hours per annum) reduced by the hours of non-availability due to unscheduled outages divided by total available hours. Average Reliability of 98.9% was achieved across relatable ADNOC Gas facilities.

About ADNOC Gas

ADNOC Gas, listed on the ADX (ADX symbol: “ADNOCGAS” / ISIN: “AEE01195A234”), is a world-class, large-scale integrated gas processing company operating across the gas value chain, from receipt of raw gas feedstock from ADNOC through large, long-life operations for gas processing and fractionation to the sale of products to domestic and international customers. ADNOC Gas supplies approximately 60% of the UAE’s sales gas needs and supplies end-customers in over 20 countries. To find out more, visit: www.adnocgas.ae

For media inquiries, please contact:

Mayyasa Saeed Al Yammahi

External Communications Manager, Communications

+971 50 1171779

mayyasa@adnoc.ae

For investor inquiries, please contact:

Zoltan Pandi

Vice President, Investor Relations

+971 56 4362067

zpandi@adnoc.ae

Release Details

August 04, 2023

August 04, 2023